Condo Insurance in and around Lincoln

Get your Lincoln condo insured right here!

Condo insurance that helps you check all the boxes

Your Search For Condo Insurance Ends With State Farm

As with any home, it's a good plan to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has great coverage options to fit your needs.

Get your Lincoln condo insured right here!

Condo insurance that helps you check all the boxes

Why Condo Owners In Lincoln Choose State Farm

Things do happen. Whether damage from wind, vandalism, or other causes, State Farm has excellent options to help you protect your unit and personal property inside against unpredictable circumstances. Agent Shawn Kreifels would love to help you develop a policy that is personalized to your needs.

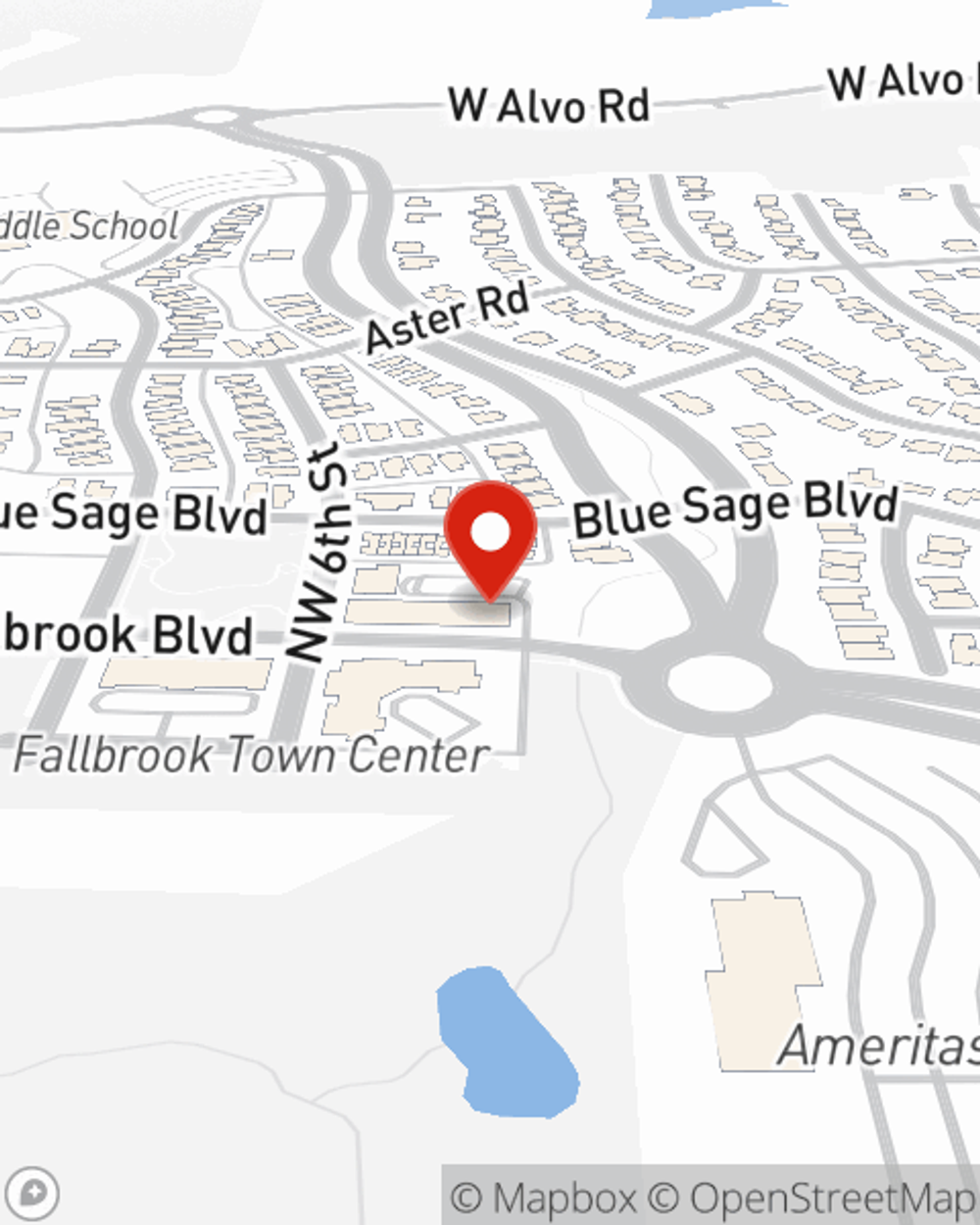

Want to learn more about the State Farm insurance options that may be right for you and your unit? Simply visit agent Shawn Kreifels's team today!

Have More Questions About Condo Unitowners Insurance?

Call Shawn at (402) 435-2250 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Shawn Kreifels

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.